UK Customs Declaration Form: A Complete Guide

Think of the UK customs declaration form as a passport for your goods. It’s the official document that tells HM Revenue and Customs (HMRC) exactly what you're bringing into the country, making sure everything is safe, legal, and correctly taxed.

Getting this form right is a critical step for everyone, from businesses importing products to individuals returning from a holiday.

Your Guide to UK Customs Declarations

Navigating customs can feel like a maze, but understanding the declaration form is your first step out. This document is key for maintaining border security, collecting the right taxes, and gathering important trade statistics.

Whether you're a tourist with a few too many souvenirs, a business importing stock, or just sending a gift to family, a correct declaration is your ticket to a smooth entry process. We’ll break down the whole thing—why it matters, who needs one, and how the modern digital system works—so you can avoid common mistakes and surprise delays.

Why Accurate Declarations Matter

An accurate declaration isn't just paperwork; it's a legal statement. Getting it wrong can lead to serious headaches, including:

- Delays: A simple mistake can flag your shipment for extra inspection, holding up your goods for days or even weeks.

- Financial Penalties: Under-declaring the value of your goods to save on tax can backfire with hefty fines.

- Seizure of Goods: In serious cases, border officials can confiscate non-compliant or prohibited items.

Who Needs to Complete a Declaration

So, who needs to fill one out? You'll almost certainly need to file a declaration if you're:

- Importing commercial goods into the UK to sell.

- Bringing in personal items that are over the duty-free allowance.

- Sending a gift to someone in the UK from another country.

- Temporarily importing items for a specific reason, like an exhibition or repair.

Knowing the rules for your goods is crucial. But for travelers, it's just as important to understand your personal entry requirements. Our guide on traveling to the UK from the USA has more specifics to ensure your own arrival is just as smooth.

Navigating the Post-Brexit Customs Landscape

Since the UK left the European Union, the way goods move across the border has changed entirely. What used to be a smooth flow of trade within the EU single market now requires a formal, and much more demanding, customs process.

This shift means that trade between the UK and the EU is now handled just like trade with the rest of the world. Every single shipment needs a formal customs declaration, turning a once-simple process into one that demands careful attention to detail and strict compliance. For businesses and travelers, it's a new layer of diligence that just wasn't necessary before.

From Simple Surveys to Formal Declarations

Before Brexit, tracking goods between the UK and EU was handled through a simpler system called the Intrastat survey. This system mainly focused on the value and volume of goods being moved. But on January 1, 2021, everything changed.

The UK's departure from the EU fundamentally altered how trade data is collected. Customs declarations are now the primary source of information for trade between Great Britain and the EU, adding new complexities and creating a break in historical trade statistics.

This move to formal customs declarations under the Taxation (Cross-border Trade) Act has had a huge impact. Now, the date a declaration is cleared—which might be different from the actual shipping date—determines the accounting period for trade statistics. This makes it tricky for analysts to compare post-2021 trade data with previous years, as detailed in recent findings on UK trade statistics. You can explore more about these data collection changes on the ONS website.

Real-World Impacts on Travelers and Businesses

This new customs landscape has very real consequences. For businesses, the extra paperwork and potential for border delays have become major operational headaches. The numbers speak for themselves: according to the National Audit Office, traders filed a staggering 39 million customs declarations in 2022 just for goods moving between Great Britain and the EU.

For travelers, it means being much more aware of personal goods allowances and declaration rules. But remember, the customs form only handles your goods. Your personal entry into the country is a separate process managed by your travel authorization. For many visitors, getting a UK Electronic Travel Authorisation (ETA) is a mandatory first step.

To ensure your UK ETA application is error-free and processed smoothly, consider using a third-party application assistance provider. AssistEntry’s UK ETA service offers expert review and full verification to increase your chances of approval. With prices starting from just $79 (it include government fee, all cost included), it’s a smart way to avoid delays and travel with confidence.

What You Must Declare When Entering the UK

Figuring out what to declare on your UK customs form can feel like a guessing game, but it all comes down to one thing: being upfront about what you're bringing into the country. The rules are a bit different depending on who you are—a traveler with a suitcase full of personal items, or a business importing goods for sale.

For travelers, the magic word is allowances. These are the set limits on things like alcohol and tobacco you can bring in without paying any tax or duty. Go over those limits, and you’ll need to declare it. The same goes for cash; if you're carrying £10,000 or more (or the equivalent in another currency), you must let customs know.

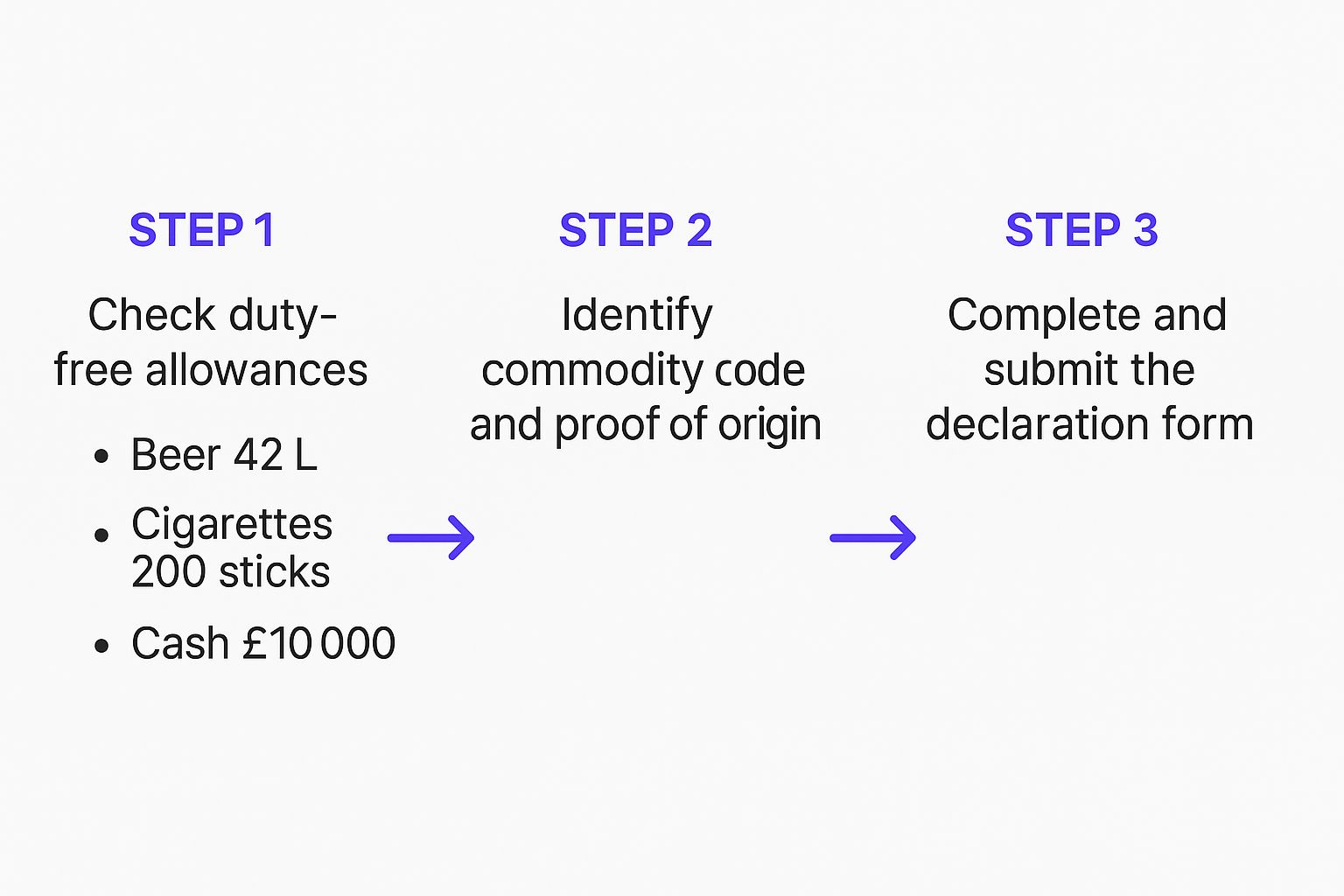

This infographic lays out the basic roadmap for getting your declaration right, whether it’s for your own stuff or for commercial stock.

As you can see, it's a simple three-part process: check your personal allowances, identify your commercial goods, and then submit the form. Easy.

Declaring Personal and Commercial Items

When it comes to your personal belongings, things are pretty simple. Beyond the duty-free stuff, you just need to declare any high-value items you’re planning to sell or use for your business. It's also critical to know the specific pet travel requirements when entering the UK, as pets have their own set of rules, declarations, and health checks.

For businesses, the declaration form asks for a lot more detail. You’ll need to have specific information ready about the goods you’re importing.

- Commodity Codes: Every product has a special code used to classify it for taxes and regulations. Getting this wrong can mean you overpay—or underpay—on duty.

- Proof of Origin: This is the paperwork that shows where your goods were made. It's essential for figuring out if you can get a better tariff rate under a trade agreement.

- Value of Goods: You have to declare the true commercial value of your items so that customs can calculate the correct duty and VAT.

A complete and accurate declaration isn’t just a formality—it’s a legal requirement. It’s what keeps you from facing delays, fines, or even having your goods seized. Having all your information in order is the single best way to make sure you sail through customs smoothly.

Personal Goods Allowances for Travelers to Great Britain

To make things clearer for personal travelers, here’s a quick rundown of the duty-free allowances for alcohol and tobacco you can bring into Great Britain (England, Wales, and Scotland) from outside the UK.

| Type of Goods | Allowance Limit |

|---|---|

| Beer | 42 litres |

| Wine (still) | 18 litres |

| Spirits and other liquors over 22% alcohol | 4 litres |

| Fortified wine, sparkling wine, and alcoholic drinks up to 22% alcohol | 9 litres |

| Tobacco | 200 cigarettes OR 100 cigarillos OR 50 cigars OR 250g tobacco (or a proportional combination) |

Remember, if you bring in anything over these amounts, you must declare it and pay the necessary tax and duty.

While the customs form handles your items, don't forget about your own entry paperwork. For many visitors, getting a UK Electronic Travel Authorisation (ETA) is a must-do step before you even book your flight. Any mistakes in your UK ETA application could throw a wrench in your travel plans. To see what the arrival process looks like once you have your ETA, take a look at our guide on arriving in the UK with an ETA and what to expect at the border.

How to Fill Out the UK Declaration Form

Looking at a customs declaration form for the first time can feel a little intimidating. But trust me, once you break it down, it's a lot more straightforward than it looks. The real secret isn't in filling out the form itself, but in the prep work you do beforehand.

Think of it like this: you wouldn't start baking a cake without getting all your ingredients on the counter first. Same principle applies here. Gather all your documents before you even think about logging into the system. It’ll save you a world of time and headaches.

Preparing Your Documents

What documents are we talking about? These are the papers that tell the story of your goods—what they are, where they came from, and what they're worth. They're your proof.

- Commercial Invoice: This is the big one. It’s the receipt for your goods, detailing the buyer, seller, a clear description of what you're importing, its value, and the quantity. It's non-negotiable.

- Transport Documents: This depends on how your shipment is arriving. It could be a Bill of Lading (for sea freight), an Air Waybill (for air freight), or a CMR note (for road freight).

- Packing List: This document gives customs a detailed look inside each box, listing the contents, weights, and dimensions.

- Licences and Certificates: If you're importing anything restricted (think certain electronics, plants, or medical products), you'll need the proper import licences to prove you have permission.

Once you've got this paperwork sorted, you're ready to tackle the digital side. This often starts with inputting personal or business details, including your passport information. If you're not sure how to get a clean digital copy for online forms, our guide on how to scan your passport walks you through it step-by-step.

Navigating the Online Portal Step-by-Step

The UK's entire customs process runs through the Customs Declaration Service (CDS). It's an online portal where you'll enter all the information from the documents you just gathered. The system is set up to walk you through a series of fields, which they call "data elements."

The screenshot below, taken from official government guidance, gives you a peek into how structured the CDS system is. You can see how every piece of information is categorized and can be requested for reports later on.

This just goes to show that every detail you enter—from your company EORI number to the specific commodity code—is logged. It's all part of the official record for compliance and accounting.

Here’s a quick walkthrough of the main sections you’ll encounter:

- Declarant and Importer Details: You'll kick things off by entering the EORI numbers (Economic Operators Registration and Identification) for both the person filing the declaration and the business that's actually receiving the goods.

- Goods Description and Commodity Code: This is where you describe your items in plain English. Then, you'll need to find the correct 10-digit commodity code using the UK Integrated Online Tariff tool. This code is absolutely critical because it dictates how much duty you'll pay.

- Customs Procedure Code (CPC): This is a seven-digit code that tells customs why you're importing the goods. Are they for sale? Is it a temporary import? Are you returning faulty products? The CPC you choose has a huge impact on your tax calculation.

- Valuation and Taxes: Here, you'll input the value of your goods directly from your commercial invoice. The system takes this value, combines it with the commodity code and the goods' country of origin, and automatically calculates any customs duty and VAT you owe.

Pro Tip: Before you hit that submit button, double-check everything. Then check it again. A tiny typo in a commodity code or a misplaced decimal in the value can cause major delays or, even worse, an incorrect tax bill. The system is smart, but it can only work with what you give it.

Getting to Grips with the UK's Digital Customs System

The UK has officially moved its customs process online, saying goodbye to the old CHIEF system (Customs Handling of Import and Export Freight) that ran for decades. The new system in town is the Customs Declaration Service (CDS), a much more modern platform built to handle the realities of today's global trade.

This wasn't just a simple software swap. The move to CDS was a massive undertaking, pushed forward by the UK's departure from the EU. The new system is designed from the ground up to manage a huge increase in customs declarations and bring the UK in line with current international data standards, making the whole process cleaner and more accurate.

Why the Customs Declaration Service is a Big Deal

Shifting to CDS brings some major wins for both the government and businesses. It captures more detailed data, which leads to better trade statistics and helps ensure everyone is playing by the rules. For importers and exporters, the system offers a single, streamlined way to submit all their information.

One of the best new features for businesses is the ability to view their own import and export data directly from HM Revenue and Customs (HMRC). This kind of self-service access is a huge leap forward from the old way of doing things.

Having direct access to your company's customs data is a powerful tool. It lets you run internal audits, double-check your tax payments, and get a clearer view of your supply chain for smarter planning.

How to Access Your Business Import Data

If you need to look back at your company's import records, CDS provides a clear process for requesting this information. This data can be a lifesaver for accounting, compliance checks, and making sharp business decisions in the post-Brexit world.

There is a fee to access this data, though. A single report from HMRC will set you back £240 plus VAT per year, with any additional reports costing the same. For businesses that need the full picture, getting all available import report categories can cost up to £960 plus VAT annually. The records go back to January 2022, marking the start of this new digital customs era. You can learn more about how to request customs declaration service data directly from the government's website.

Just remember, while CDS handles how goods cross the border, your personal entry into the country is a separate process. It's crucial to understand all the necessary travel requirements for the UK, including the mandatory Electronic Travel Authorisation (ETA) for eligible visitors. Getting both your goods and personal entry sorted is the key to a smooth trip.

Simplify Your Entry with a UK ETA

While the customs declaration form handles the goods you’re bringing in, a totally separate document manages your personal entry into the country: the UK Electronic Travel Authorisation (ETA).

This digital permit is now a must-have for travellers from many visa-exempt countries, including the United States. Think of it this way: if the customs form is a passport for your luggage, the ETA is the digital key that unlocks the door for you.

Getting your UK ETA is a critical pre-travel step, and you need to get it right to avoid any headaches at the airport. The application involves submitting personal information, and even a tiny typo can lead to delays or a flat-out denial. To sidestep these problems, many travellers are now turning to trusted application assistance services.

Why Use a Professional Service?

Let's be honest—navigating any official government application can be a bit tricky. A dedicated third-party application assistance provider acts as a second pair of eyes, making sure every single detail is correct before your application is sent off.

To simplify your ETA application and increase your chances of approval, consider using AssistEntry — their experts guide you through the entire process, starting from just $79.

That fee covers all the government costs and includes full verification, error-checking, and a compliance review. For travellers who just want peace of mind, having an expert handle your application ensures everything is done right and helps you avoid common mistakes.

You can learn more about the UK ETA and see how it affects your travel plans in our detailed guide.

Common Questions About UK Customs and Travel

Navigating UK customs can feel a bit overwhelming, but it doesn't have to be. Let's clear up a few of the most common questions travelers have.

What Happens If I Make a Mistake on My Declaration?

It happens. An honest mistake on a UK customs declaration form can lead to delays, extra inspections, or the wrong tax calculation. The key is to act fast.

If you spot an error, contact HMRC right away to get it amended. For businesses, this often means filing a post-clearance amendment. To sidestep these headaches entirely, many people work with a customs agent from the start.

Do I Need a UK ETA for Transit?

Yes, you almost certainly do. If you’re from a country that requires a UK Electronic Travel Authorisation, you’ll need one even if you're just passing through a UK airport without officially entering the country.

Always double-check the specific travel rules for your nationality before you book your flights. This will save you a lot of trouble at the border.

Can I Bring Food into the UK for Personal Use?

The UK is very strict about what food you can bring in, and the rules depend on where you're coming from.

Bringing meat and dairy from non-EU countries is heavily restricted. On the other hand, bringing limited amounts of fruit, vegetables, or eggs from the EU is usually fine. The golden rule? Check the latest government guidelines before you pack anything. The penalties for bringing in prohibited items can be severe.

Your journey to the UK should be exciting, not stressful. For a smooth and error-free UK ETA application, let the experts at AssistEntry handle it for you.

As a third-party application assistance provider, our team reviews every detail of your application for accuracy and compliance, giving you the best possible chance of a quick approval. For a fee starting from just $79 (it include government fee, all cost included), you can travel with complete peace of mind.

Simplify your travel plans and apply through AssistEntry’s UK ETA page today.